does instacart take out taxes for employees

Web Q4 Deadline. This tax form summarizes your income for the year deductions.

Doordash Taxes Does Doordash Take Out Taxes How They Work

In-store shoppers dont have to worry about the tax as Instacart takes care of it.

. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission. Youll need to set aside money to pay taxes each quarter more below. Except despite everything you have to put aside a portion.

Instacart does take out taxes if you are an in. Additional fees may apply to your. January 16 2023 Pay estimated taxes for Sept 1 to Dec 31 Find out if you owe quarterly taxes here.

There are seven tax brackets for 2022. This is a standard tax form for contract. Web The taxes on your Instacart income wont be high since most drivers are making around 11 every hour.

Its possible that this varies per state. Web What Taxes Do Instacart Shoppers Need to Pay. What documentation do I need to file my.

If you make more than 600 per tax year theyll send you a 1099-MISC tax form. This includes self-employment taxes and income taxes. Web Instacart 1099 Tax Forms Youll Need to File.

Web Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Like all other taxpayers youll need to file Form 1040. 10 12 22 24 32.

Web Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax. Web Taxes for Shoppers in-Store. Web Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

Web You will be considered an employee if you are an in-store shopper at Instacart. They will pay Instacart. Web Your employer covers the other amount totaling 153.

Web To learn if Instacart takes out taxes how Instacart hires felons and what is Instacart you can check our blog posts on those issues. Even if you incorporate and put yourself on payroll if you own more than 2 of the business you. No taxes are taken out of your Doordash paycheck.

Web For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. This stuff applies just as much for Instacart Uber Eats Grubhub. As a self-employed individual youre considered the employer and employee and are responsible for paying the full.

Web Does Instacart take out taxes for its employees. Web You do not submit payroll taxes and dont run an actual payroll. Web The rates employees are expected to pay for federal income taxes vary based on their income bracket.

Get answers to your biggest company questions on Indeed. Web If youre an employee stop reading. They will owe both income and self-employment taxes.

Web Instacart doesnt take out taxes. Web For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. Instacart can tell you if youre eligible.

Instacart employees include in-store customers. Instacart doesnt pay for gas or other expenses. Web Find answers to Do they take out taxes from Instacart employees.

Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes.

Self Employment Taxes A Guide For Food Delivery Drivers

Instacart Sues Seattle Over Premium Pay For Gig Workers Loophole For Food Delivery Remains

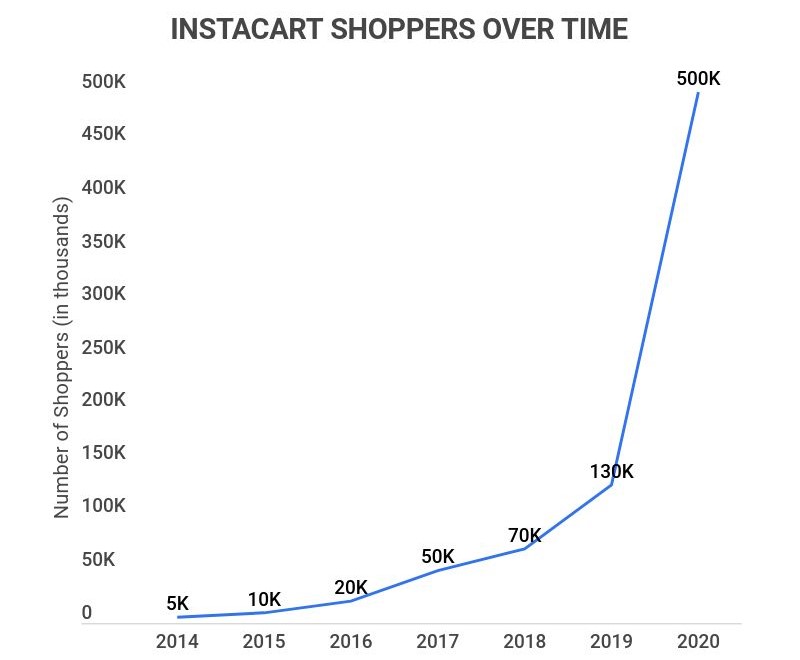

Instacart Statistics 2022 Users Revenue Growth And Grocery Ecommerce Market Trends Zippia

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms

What You Need To Know About Instacart 1099 Taxes

Be An Instacart Shopper Instacart Shopper Pay And Instacart Driver Info

Publix Offers Grocery Delivery Through Business Partnerships Powered By Instacart Georgia Trend Magazine

Instacart Shoppers Can Now Choose To Be Real Employees Wired

Instacart Driver Review 10k As A Part Time Instacart Shopper

Be An Instacart Shopper Instacart Shopper Pay And Instacart Driver Info

As Instacart Looks To Expand Its Services It Takes Steps To Retain Talent Insider Intelligence Trends Forecasts Statistics

Everything You Need To Know About 1099 Write Offs Giggle Finance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Why Are Instacart Workers Calling On Costco For Support Payup

What You Need To Know About Instacart Taxes Net Pay Advance

How To File Your Taxes As An Instacart Shopper Contact Free Taxes

Partnering With Stride To Bring Shoppers Affordable Insurance

How To Become An Instacart Shopper Driver Is It Worth It

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make